If you’ve been reluctant to put your house on the market due to concerns about a lack of buyers, this could be your signal to reach out to an agent.

After months of high interest rates keeping buyers on the sidelines, the market is starting to shift. Rates are already declining due to various economic factors. Yesterday, the Federal Reserve reduced the Federal Funds Rate for the first time since it began raising it in March 2022. While the Fed doesn’t directly control mortgage rates, this move sets the stage for mortgage rates to drop even further—especially with more cuts anticipated next year. As mortgage rates decrease, more buyers are returning to the market. Lisa Sturtevant, Chief Economist at Bright MLS, explains:

“A drop in the cost of borrowing will help fuel more homebuyer demand . . . Falling rates will also bring more sellers into the market.”

The best part? You can capitalize on the renewed interest from buyers.

As Rates Fall, Buyer Activity Goes Up

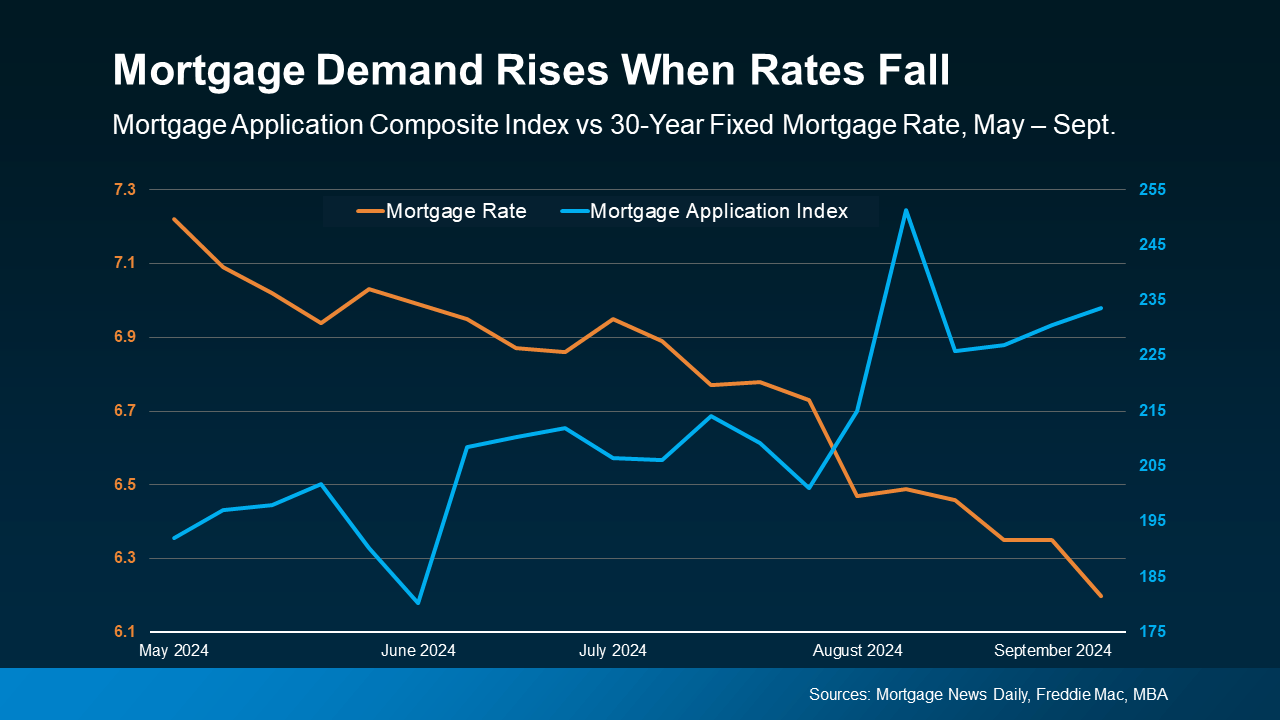

The graph below highlights the connection between declining mortgage rates and increasing buyer activity. The orange line represents the average 30-year fixed mortgage rate, while the blue line indicates the Mortgage Bankers Association (MBA) Mortgage Application Index, which measures the volume of mortgage applications.

As shown in the graph below, as mortgage rates (orange) decrease, the Mortgage Application Index (blue) increases, indicating that more people are re-entering the market.