Debating whether to rent or buy a home? A major factor to consider is how homeownership can help grow your net worth over time.

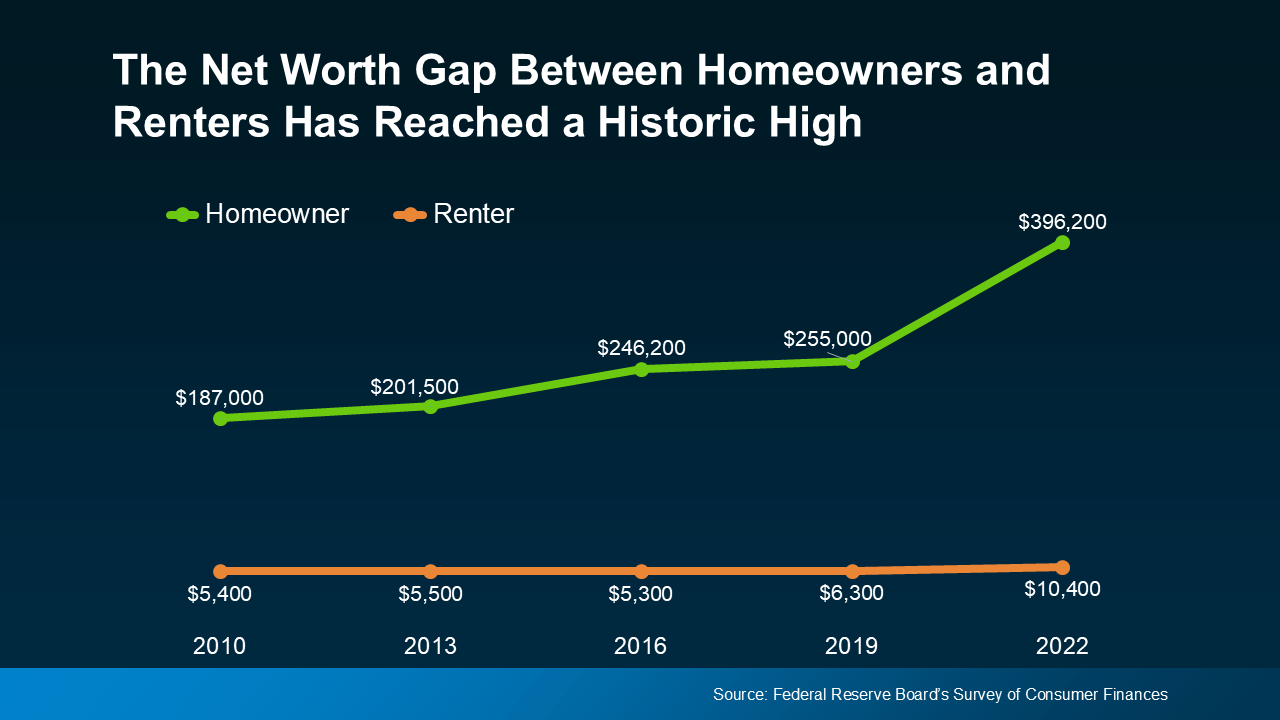

Every three years, the Federal Reserve releases the Survey of Consumer Finances (SCF), which compares the wealth of homeowners and renters—and the gap is striking.

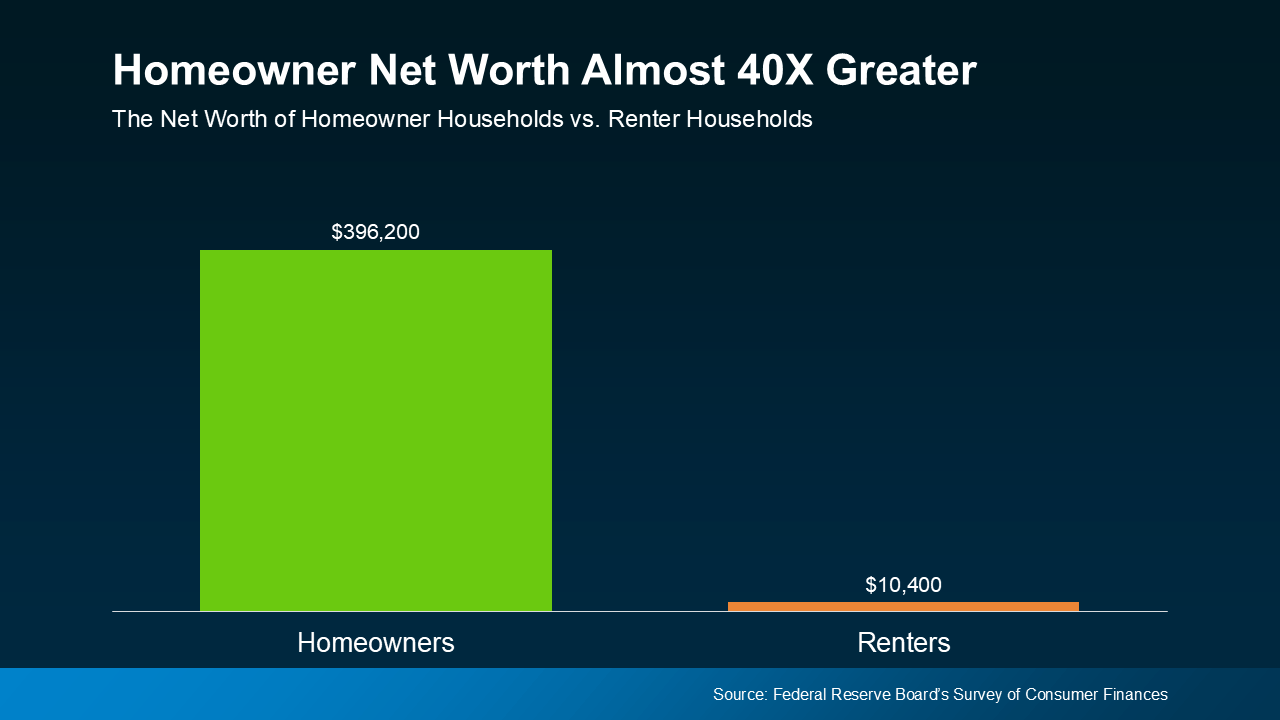

On average, homeowners have a net worth nearly 40 times greater than renters. Take a look at the graph below to see the difference:

Why Homeowner Wealth Is So High

In the previous version of that report, the average homeowner’s net worth was around $255,000, compared to just $6,300 for renters—still a significant gap. However, in the latest update, the difference has grown even wider, with homeowner wealth continuing to rise (see graph below):