With home prices climbing and mortgage rates fluctuating, it’s crucial to explore every resource that can make homeownership more attainable. One key option to be aware of is the significant increase in the availability of down payment assistance (DPA) programs.

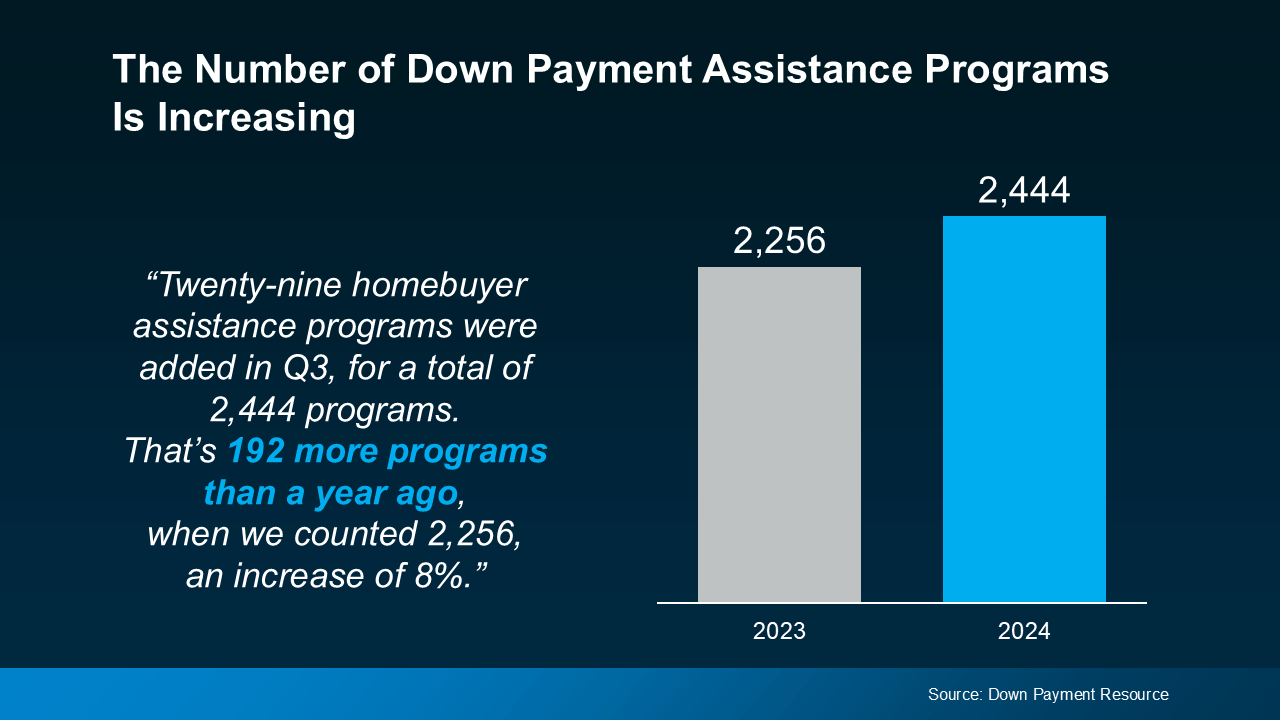

Check out the graph below to see how many new programs have been introduced over the past year, based on data from Down Payment Resource: