You’ve been diligently saving and imagining the day you finally hold the keys to a home of your own. What you might not have considered is that your tax refund could give you the boost you need to get there a little faster. As Freddie Mac explains:

“ . . . your tax refund from the IRS can be a useful supplement to your homebuying budget.”

If you’re receiving a tax refund this year, it could be the perfect opportunity to put that money toward some of the upfront costs of buying a home—like your down payment or closing costs. And here’s the good news:

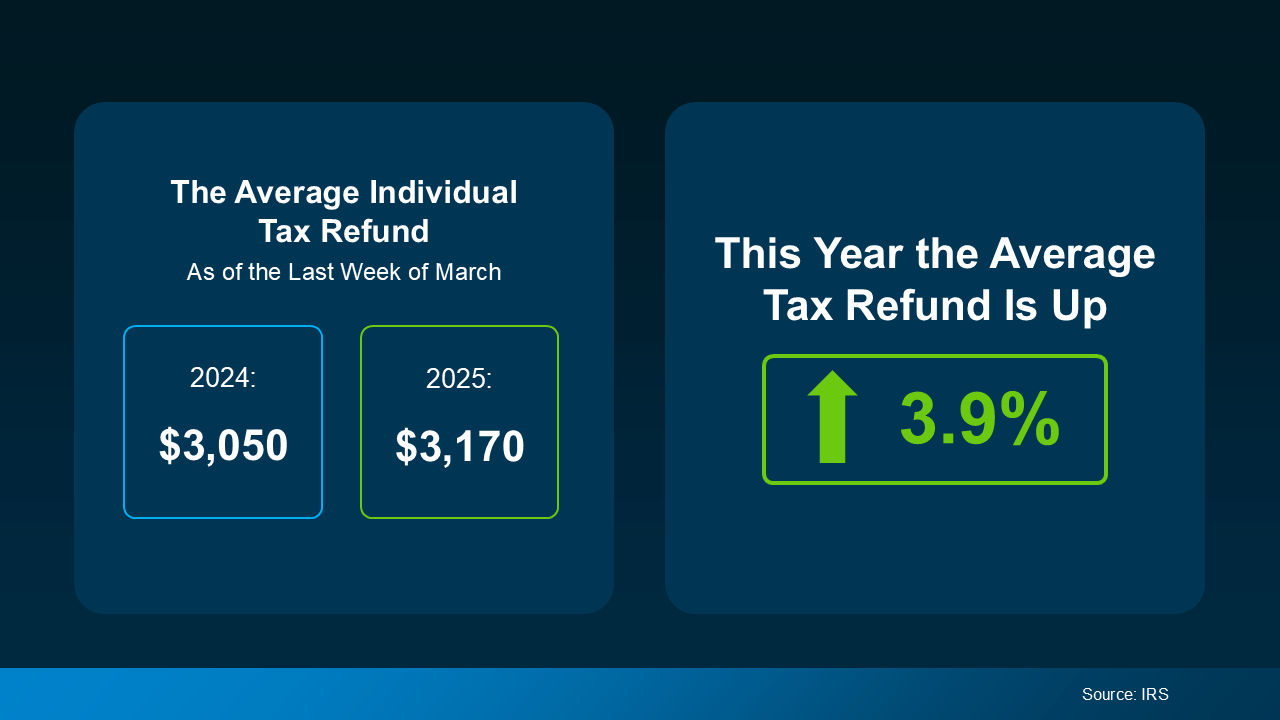

On average, people are seeing slightly larger refunds than last year. It’s not a huge jump, but as the visual below shows—based on data from the IRS—refund amounts are up by 3.9% this year.

Of course, your tax refund amount will vary based on your individual situation. But when you’re planning to buy a home, every bit of extra cash can make a difference. According to Freddie Mac, here are a few smart ways you can put that money to work:

-

Boost Your Down Payment – Saving for a down payment is often one of the biggest challenges for buyers. Using your tax refund can help you reach that goal faster. And keep in mind—you don’t always need 20% down to buy a home.

-

Cover Closing Costs – Closing costs typically range from 2% to 5% of the home’s purchase price and include things like the appraisal, title insurance, and loan processing fees. Putting your refund toward these expenses can help ease the financial load on closing day.

-

Lower Your Mortgage Rate – Some lenders allow you to “buy down” your mortgage rate by paying upfront. If you qualify, using your refund this way could reduce your monthly payment and make homeownership more affordable in the long run—especially in today’s market.