Retirement isn’t just a finish line — it’s the start of a whole new adventure.

After years of dedication and hard work, it’s your time to relax, discover new passions, and enjoy life on your own terms.

But with this exciting new chapter comes some important decisions. One of the biggest? Is your current home still the right fit — for both the lifestyle and budget you envision in this next phase of life?

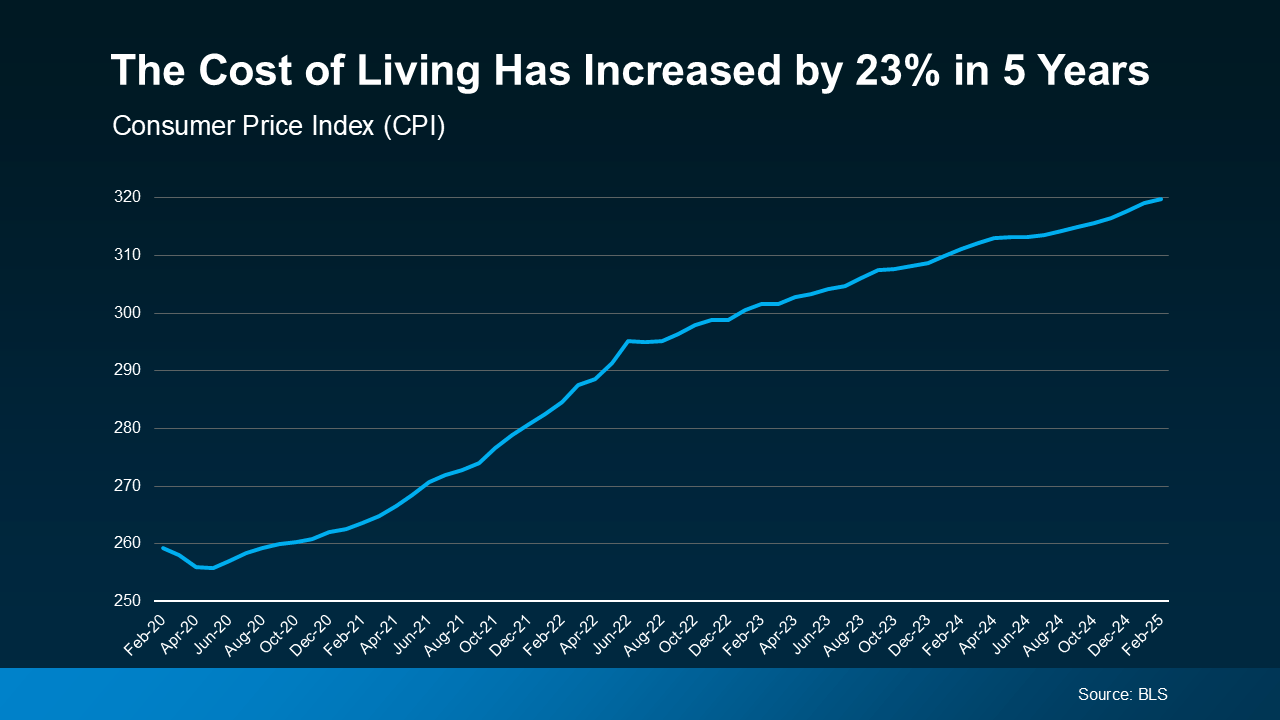

That question is more important now than ever. In just the past five years, the cost of living has risen by 23%, according to the Bureau of Labor Statistics. That increase is based on the Consumer Price Index (CPI), which tracks changes in the average prices people pay for everyday goods and services (see graph below):