Curious about what the housing market holds this year? Specifically, how it will impact your plans to buy or sell a home? The best way to get reliable insights is to turn to the experts. They’re constantly updating their forecasts, so here’s the latest on two key factors expected to shape the year ahead: mortgage rates and home prices.

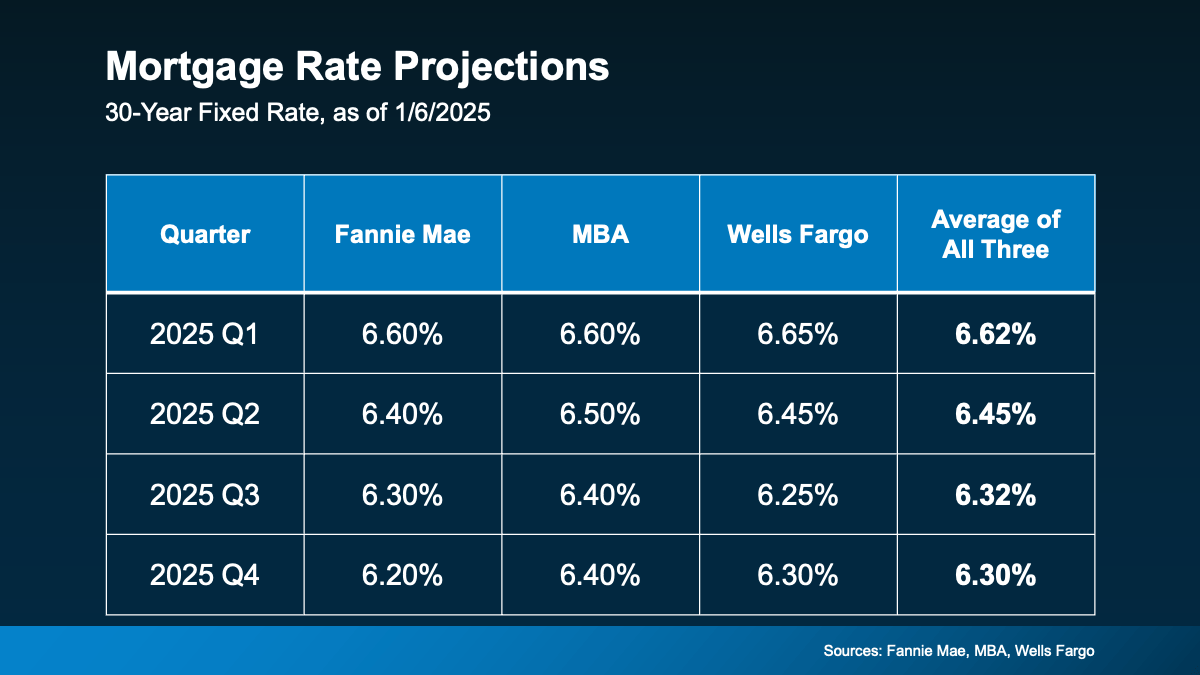

Will Mortgage Rates Come Down?

Everyone’s watching mortgage rates, hoping for a drop. The real question is: how much and how quickly? The good news is that rates are expected to ease somewhat in 2025. However, don’t expect a return to the 3-4% rates we saw in the past. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), puts it:

“Are we going to go back to 4%? Per my forecast, unfortunately, we will not. It’s more likely that we’ll go back to 6%.”

Other experts are on the same page. They predict rates may settle in the mid-to-low 6% range by the end of the year (see chart below):