The concept of the American Dream has long been associated with the idea of success, freedom, and prosperity, often symbolized by owning a home. It’s a vision that represents stability, security, and the rewards of hard work. While the specifics of this dream can vary greatly from person to person, the underlying values of achieving personal success, having the freedom to pursue one’s passions, and enjoying a prosperous life are commonly shared aspirations.

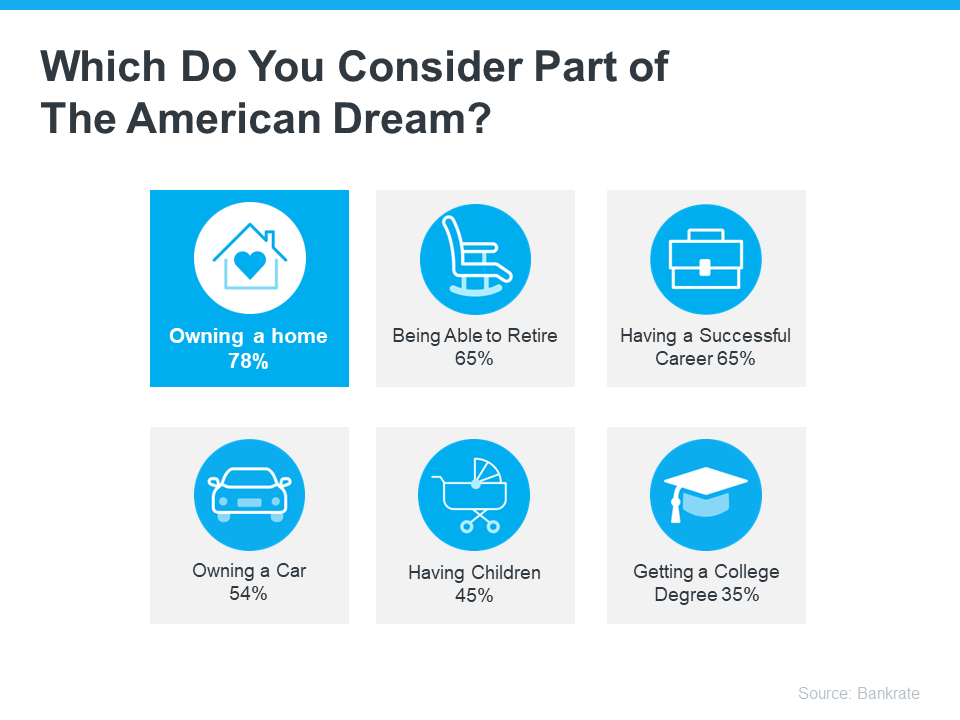

It’s interesting to see that homeownership continues to hold a prominent place at 78% in the American Dream. According to a recent survey by Bankrate reveals(see graph below):

Buying a home is often viewed as a significant step toward securing one’s future, beyond just a financial investment. Despite current challenges like higher mortgage rates and rising home prices, the long-term benefits can indeed make it worthwhile. Homeownership offers stability, potential wealth accumulation through equity building and property appreciation, and the freedom to customize and manage your living space according to your preferences.

It’s essential for potential homebuyers to weigh these benefits against the responsibilities and costs associated with owning a home, such as maintenance, property taxes, and insurance. Making an informed decision based on both short-term affordability and long-term financial goals is crucial when considering homeownership.