Deciding whether to move with today’s mortgage rates involves several considerations, each unique to your personal situation and financial goals. Here are some key points to ponder as you make your decision:

**Current Mortgage Rates vs. Locked-In Rate**: If you currently have a significantly lower mortgage rate than what is available today, moving would mean accepting a higher rate on a new mortgage. Calculate the potential increase in your monthly payments and consider whether this aligns with your budget and long-term financial plans.

**Future Mortgage Rate Projections**: Although rates are higher now compared to recent lows, they may still adjust downward in the future. However, timing the market can be risky and uncertain. If you wait for rates to drop, you could face increased competition from other buyers, potentially driving up home prices.

As Mark Zandi, Chief Economist at Moody’s Analytics, explains:

“Listings are up a bit as life events and job changes are putting increasing pressure on locked-in homeowners to sell their homes. Homeowners may also be slowly coming to the realization that mortgage rates aren’t going back anywhere near the rate on their existing mortgage.”

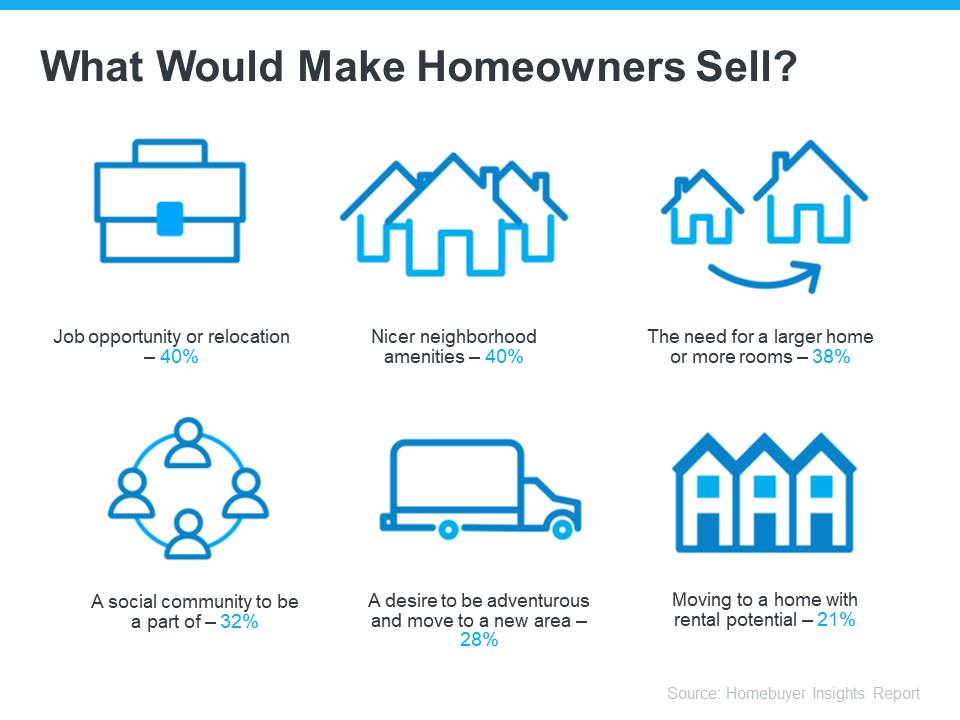

**Your Personal and Professional Needs**: Are changes in your life prompting a need to move? Consider factors such as a new job, needing more space, or wanting a different community. These personal factors can often outweigh the financial implications of a higher mortgage rate.

A recent study from Bank of America sheds light on some of the things homeowners say would make them sell, even with rates where they are right now (see visual):

**Market Conditions in Your Area**: The state of the local real estate market can impact your decision. If you’re in a seller’s market, you might fetch a higher price for your current home but face stiffer competition and higher prices when buying a new one. Conversely, a buyer’s market might mean getting a deal on a new home but receiving less for your current one.

**Market Conditions in Your Area**: The state of the local real estate market can impact your decision. If you’re in a seller’s market, you might fetch a higher price for your current home but face stiffer competition and higher prices when buying a new one. Conversely, a buyer’s market might mean getting a deal on a new home but receiving less for your current one.

**Long-Term Homeownership Goals**: Think about your long-term goals for homeownership. Are you looking for a “forever” home, or is this move a step toward something else? Your plans for the length of time you intend to stay in the home can influence whether it’s wise to move now or wait.

**Financial Health**: Evaluate your overall financial situation, including savings, debt levels, and job stability. Ensuring that you are financially secure, especially if moving would entail taking on a larger or more expensive mortgage, is crucial.

**Consultation with Professionals**: Speak with a financial advisor or mortgage broker who can offer personalized advice based on your financial circumstances and the current mortgage landscape. They can provide insights into whether it makes sense to buy now or wait.

Bottom Line:

Ultimately, whether it’s worth moving now with higher mortgage rates depends on balancing your personal needs and desires with the economic implications of the move. If the personal and professional benefits of moving outweigh the financial downsides of a higher rate, it could very well be the right time for you to make a move.