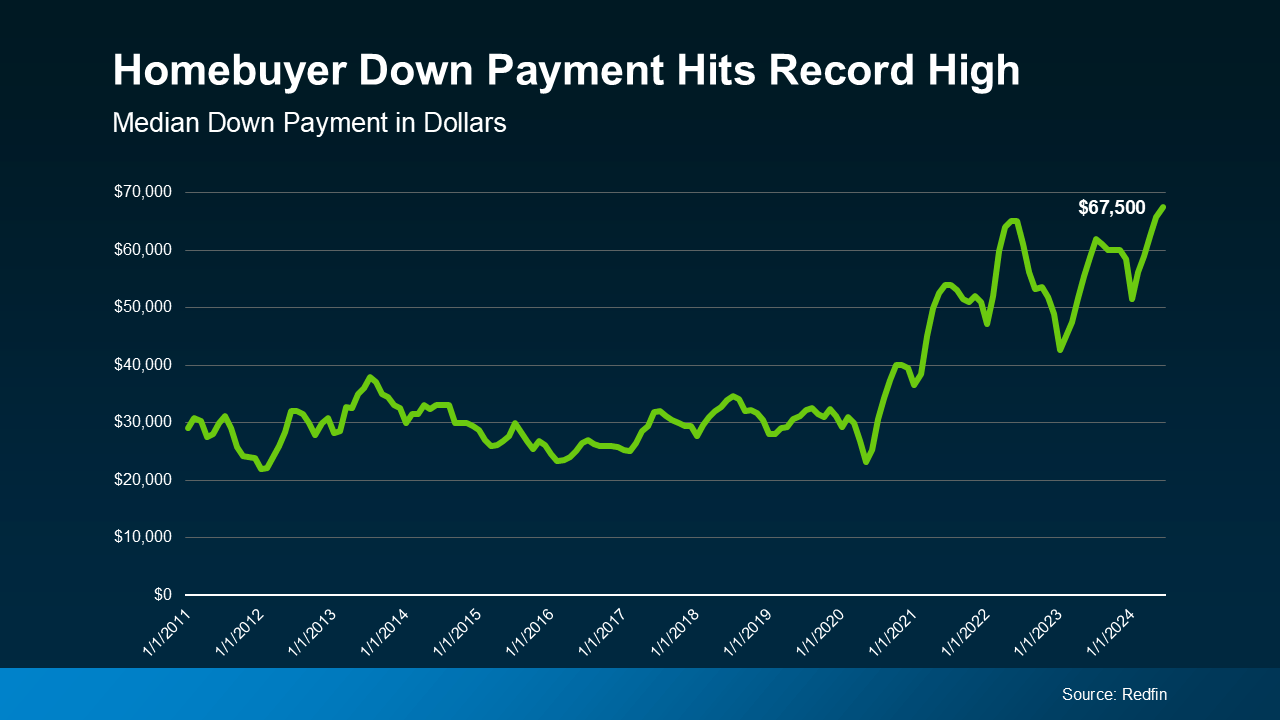

Did you know? Homeowners frequently have the opportunity to make a larger down payment when purchasing their next home. This is because, upon selling their current home, they can apply the equity they’ve built toward the down payment for their new property. As home equity continues to rise, we’re seeing the median down payment increase as well.

Recent data from Redfin shows that the average down payment for U.S. homebuyers is $67,500. This represents an increase of nearly 15% from last year and is the highest amount recorded to date (see graph below):