It seems like there’s a lot happening in the housing market, especially with mortgage rates. The increase in rates is largely attributed to factors like the Federal Reserve’s decisions on monetary policy and the current state of inflation. While there’s hope for rates to decrease later in the year, it’s uncertain exactly when that will happen due to various economic factors and uncertainties.

Economic Factors That Impact Mortgage Rates

When it comes to mortgage rates, things like the job market, the pace of inflation, consumer spending, geopolitical uncertainty, and more all have an impact. Another factor at play is the Federal Reserve (the Fed) and its decisions on monetary policy. And that’s what you may be hearing a lot about right now. Here’s why.

The Fed decided to start raising the Federal Funds Rate to try to slow down the economy (and inflation) in early 2022. That rate impacts how much it costs banks to borrow money from each other. It doesn’t determine mortgage rates, but mortgage rates do respond when this happens. And that’s when mortgage rates started to really climb.

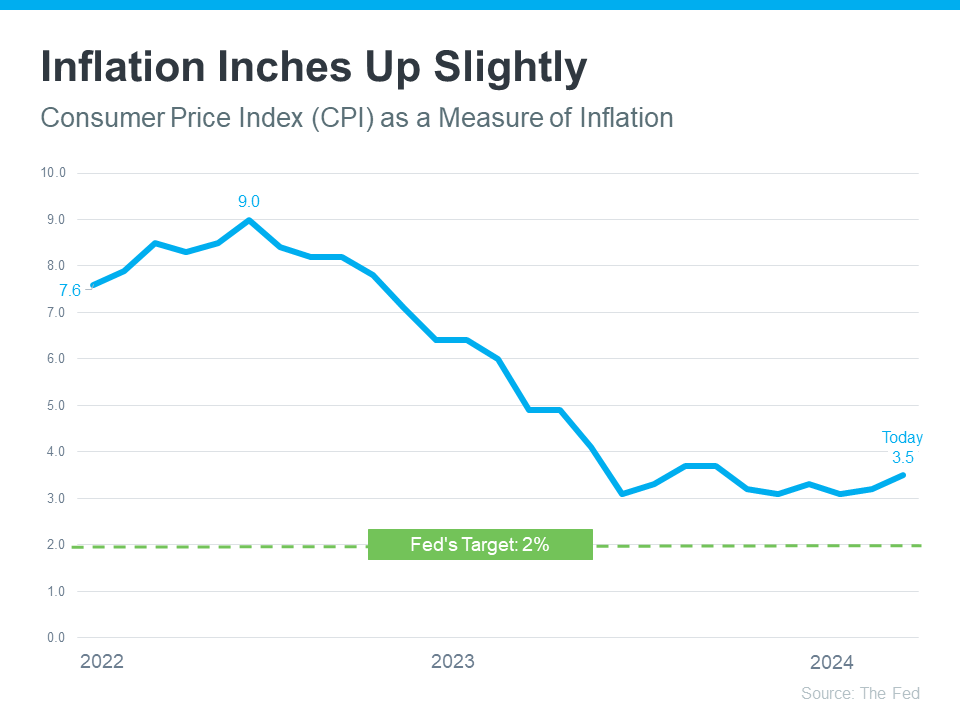

And while there’s been a ton of headway seeing inflation come down since then, it still isn’t back to where the Fed wants it to be (2%). The graph below shows inflation since the spike in early 2022, and where we are now compared to their target rate:

As the graph shows, we’re much closer to their goal of 2% inflation than we were in 2022 – but we’re not there yet. It’s even inched up a hair over the last 3 months – and that’s having an impact on the Fed’s plans. As Sam Khater, Chief Economist at Freddie Mac, explains:

“Strong incoming economic and inflation data has caused the market to re-evaluate the path of monetary policy, leading to higher mortgage rates.”

Basically, long story short, inflation and its impact on the broader economy are going to be key moving forward. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“It’s the longer-term outlook for economic growth and inflation that have the greatest bearing on the level and direction of mortgage rates. Inflation, inflation, inflation — that’s really the hub on the wheel.”

When Will Mortgage Rates Come Down?

Based on current market data, experts think inflation will be more under control and we still may see the Fed lower the Federal Funds Rate this year. It’ll just be later than originally expected. As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), said in response to the Federal Open Market Committee (FOMC) decision yesterday:

“The FOMC did not change the federal funds target at its May meeting, as incoming data regarding the strength of the economy and stubbornly high inflation have resulted in a shift in the timing of a first rate cut. We expect mortgage rates to drop later this year, but not as far or as fast as we previously had predicted.”

In the simplest sense, what this says is that mortgage rates should still come down later this year. But timing can shift as new employment and economic data come in, geopolitical uncertainty remains, and more. This is one of the reasons it’s usually not a good strategy to try to time the market. An article in Bankrate gives buyers this advice:

“ . . . trying to time the market is generally a bad idea. If buying a house is the right move for you now, don’t stress about trends or economic outlooks.”