Today’s mortgage rates and home prices might make you question whether it’s the right time to buy. While market factors matter, it’s important to consider the long-term benefits of homeownership. People who bought homes 5, 10, or even 30 years ago rarely regret it, as home values typically rise over time, boosting their net worth. Here’s how that adds up over the years.

Home Price Growth over Time

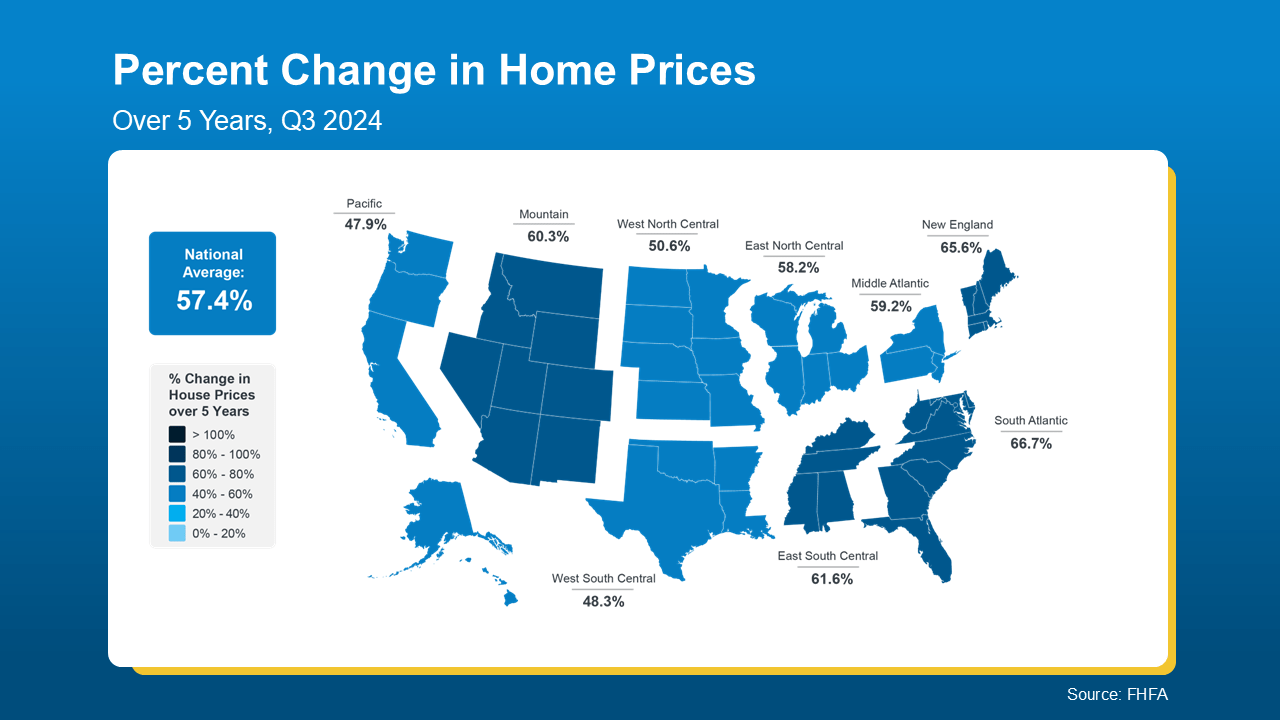

The map below, based on data from the Federal Housing Finance Agency (FHFA), highlights home price growth over the past five years. It’s broken down by region to better illustrate broader market trends.

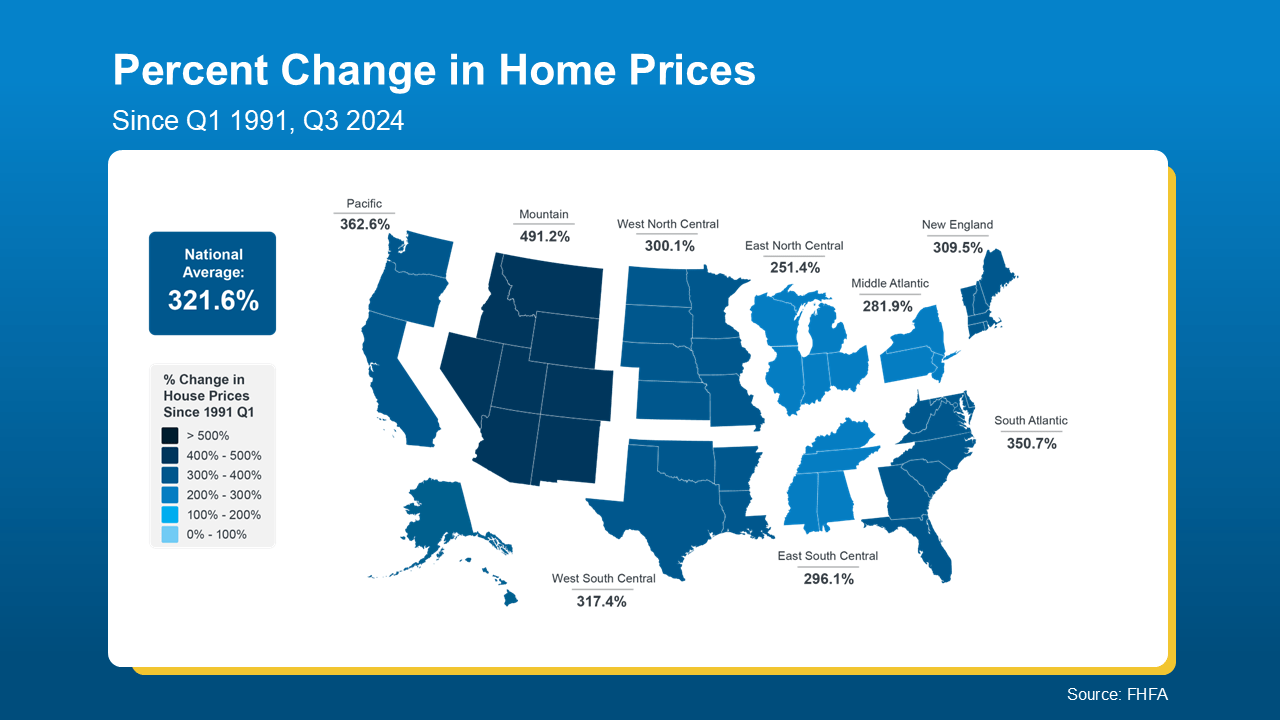

Nationally, home prices have risen by over 57% in just five years. While some regions are slightly above or below that average, the overall trend shows a significant increase in a short period. Looking at the bigger picture, the long-term benefits of homeownership—and the substantial gains homeowners have seen—become even more evident (see map below):