As prices continue to climb, it’s understandable to be anxious about the potential effects on the housing market. The worry is that increased expenses and limited budgets might lead to more homeowners struggling with their mortgage payments, which could result in a surge of foreclosures. Lets take a closer look at the current situation.

Recent foreclosure data indicates that there is no significant wave approaching.

How Today’s Market Is Different from 2008

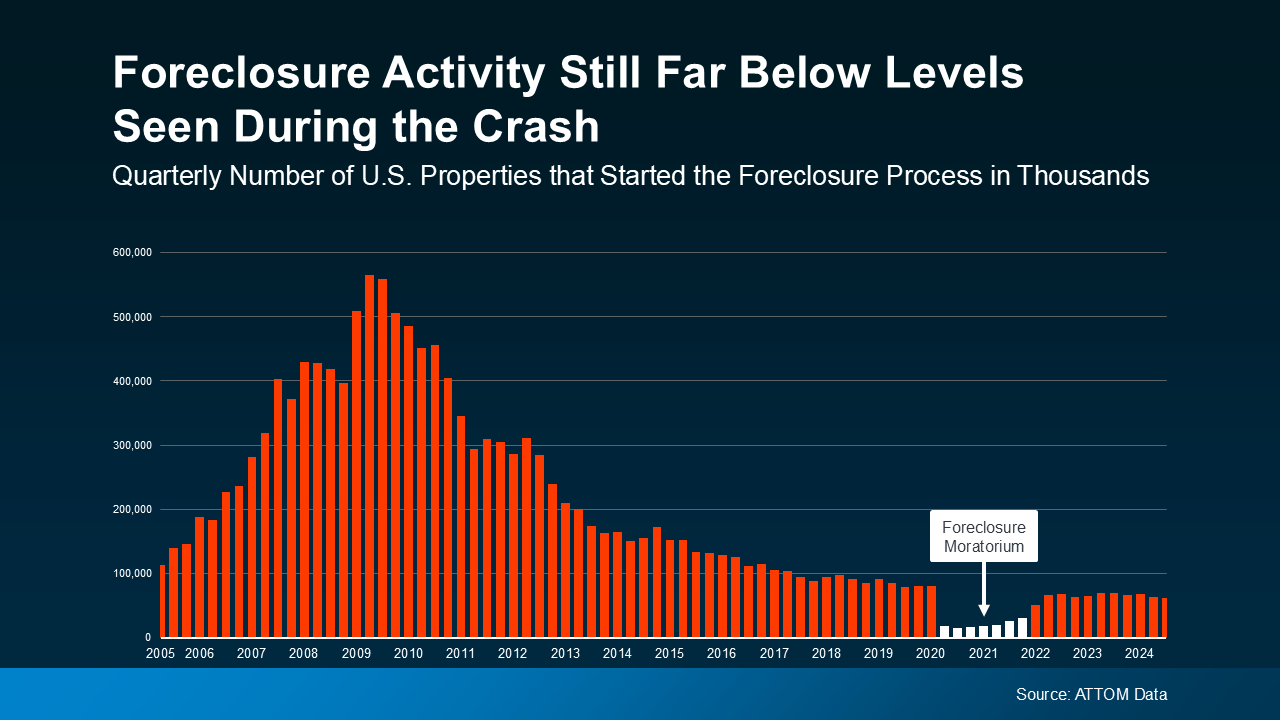

The graph below, based on research from ATTOM, a property data provider, illustrates that the number of homeowners entering the foreclosure process is far from the levels we saw in 2008. During that time, there was a significant surge in foreclosures. In contrast, current numbers are much lower, with a recent drop noted in the latest report. There’s a substantial difference between today’s situation and what occurred during the housing market crash. (see graph below):